To Secondary or Not to Secondary

Photo by Lefty Kasdaglis on Unsplash

Photo by Lefty Kasdaglis on Unsplash

A few weeks ago we posted an article about how to handle capital when offering shares through a secondary sale – or when taking cash in a dividend recap situation.

It didn’t take long before I received a note from Rob Cummings. To end the email Rob said, “while it was nice to reward myself with some liquidity for all of our hard work…, I do think about what could have been had I rolled.” Naturally that sentence grabbed my attention and I asked Rob if he’d be willing to co-author the follow up with me – the case for and the case against a secondary sale.

Fortunately, Rob agreed!

Before we dive into the pros and cons, it’s worth mentioning that not every Venture Capital or Private Equity investor wants to see their company founders taking money off the table. Clearly they want the founding team – which is one of, if not, the primary reason they made the investment in the first place – to be invested in the success of the company. And if they do allow you to sell some founder shares, they will clearly limit the amount they offer.

With that foundation laid, let’s dive right into arguments for taking secondary or rolling your equity. Here is Rob’s personal argument for why he did it.

Rob Cummings: Why founders should look to participate in the secondary!

My business partner and I started working in the equivalent of a closet at Packard Place (listen to their podcast post exit here). We had put in a grueling five years of 80-hour weeks paying ourselves below market. Early on we had written checks from our bank accounts and raised a small friends and family round to capitalize our startup.

Finally, the same institutional investors that had turned us down because our total addressable market was too small were starting to call us with interest in investing. We had built a profitable business over those five years and had measurable annual recurring revenue. However, we were still taking a very calculated approach to spending money and hiring employees to grow our startup.

Soon thereafter, a Venture Capital firm sent along a term sheet for $5.3M and were willing to allow some early friends and family investors and the co-founders to cash out some shares – or more simply put – take some chips off the table. We were faced with a tough decision. Do we “roll” all our equity or take a bonus for the hard work we had logged since company inception?

I decided to take $350,000 of cash from that fundraise. I knew that this $350k could be worth a lot more down the road if we were successful. But there were risks involved and we could no longer just “bet on ourselves.” We wouldn’t control our Board of Directors and it was inevitable that some of our decisions would be met with resistance. We had new partners that we also had to bet on to continue to grow our business. We had incredible momentum and I personally believed whole-heartedly in our business model and high performing team.

But it was time for me to personally take some chips off the table. With hindsight now 20/20, if I rolled those chips it would have returned 10x in less than 3 years when I eventually exited the business.

So why take the chips off the table? I had my personal story, but I also spoke to two other Charlotte Founders that did the same. I found four recurring themes as to why to do it:

1) family financial obligations,

2) risk aversion,

3) diversification, and

4) financial security.

Let’s break these reasons down further.

Family Obligations: When speaking with two other founders, both had situations where they needed to provide for their families. One had a child that had been diagnosed with a serious health issue and while that child had made tremendous progress, there were still a lot of unknowns. The other founder had retiring parents that required financial assistance.

Risk Aversion: Admittedly, this is one of the reasons I opted for some liquidity. I knew I was no longer in complete control of our business and had to bet on my new VC partners. I was a little bit older so I had lived through the tech bubble and the 2008 financial crisis. While I didn’t know it at the time, COVID was right around the corner. Outside factors beyond your control can always impact any business.

Diversification: Most founders will tell you that their generational wealth is tied to the success of their business. If your startup hits, it could be financially life changing. But if it does not, it could have the opposite impact. I know of founders that have tapped their home equity line or put personal guarantees on a small business loan to support their businesses. They need to diversify that risk and getting some early liquidity is a way to do that.

Financial Security: While $350k was not going to allow me to retire, it was still a lot of money that if invested correctly, would continue to grow into my retirement. That additional security was important to my family and I. I was able to pay off my mortgage, put some cash into safe investments, all while knowing that I still had a lot of upside with the equity that I rolled.

While William will argue to bet on yourself and roll your equity, I am comfortable with the decision I made.

I admit that I never went back and “did the math” on what could have been until I wrote this article. But it was absolutely the correct decision to make at that time. We continued to build a great business following that Series A round and I am thankful that our VC partners gave us that opportunity.

William Bissett: Why founders should keep their shares!

Rob’s argument is a very good one and it makes sense to a lot of people. Yet, I think of Eminem in this situation.

Look, if you had one shot, or one opportunity

To seize everything you ever wanted, in one moment

Would you capture it, or just let it slip?

If you have caught lightning in a bottle and this is your shot, do you want to let it slip to someone else?

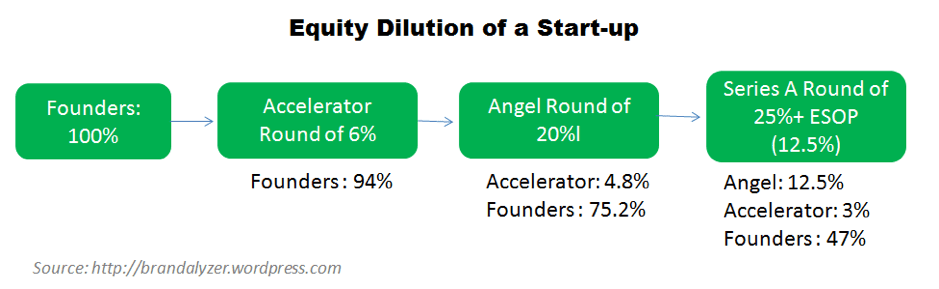

We know that startup investors want to see the potential for their investment to at least 10X from where they bought it. We also know there is founder dilution with every capital raise – which we will touch on shortly.

If the general assumption is the business is able to 10X from your secondary sale then it is very easy to think about how much you are leaving on the table. For every $100k of stock you sell now, you lose $1 million in future value. But if the company does 50X from current value then for every $100k you sell now, you give up $5 million in the future.

In Rob’s example, if they had waited longer to exit and the business done 5X more (50X instead of 10X), then he would have left an additional $17.5M+ of wealth to end up in someone else’s hands, assuming no further dilution.

With proper estate planning (using GRATs, funding an IDGT or spillover Trusts, etc.), these funds can change the lives of kids, grandkids, and even brothers/sisters, and moms/dads. As Charlotte’s startup ecosystem continues to evolve and grow, it means the infrastructure to support startups to go public is going to strengthen. And that path only heightens how much would be left on the table with a secondary.

And even if it’s not leaving wealth to your family, it allows you to direct which charities and causes could benefit from your wealth creation event rather than letting that wealth be directed by someone else.

The other reason NOT to lighten up your shares in a secondary is because of future dilution. It is likely the company will raise more money down the road and when they do your shares will represent a smaller portion of the company. Selling shares now and being diluted further in future capital raises means you’ll participate even less in the company you built.

There are many ways to think about dilution over the lifecycle of a startup and there are all kinds of rules of thumb. Using the very simple illustration below, the founder here ends up with 47% of the company after the Series A and further dilution would occur at a Series B as well. And there are certainly situations whereby the founders are down to 10-20% of ownership by Series B. Under those assumptions, keeping everything you can becomes more important.

Conclusion

There is no right or wrong answer when these opportunities arise. We’ve seen situations arise where one founder participates in the secondary and the other does not. This doesn’t mean one founder is right and the other is wrong. It means one founder analyzed the company and their own personal needs and came to different conclusions.

We’ve long been fans of modeling financial events as they could progress and discussing the opportunities and negative impacts under each scenario. What happens if it’s only a 5x event or if you get laid off by the new board during a challenging time for the company. One the other hand, what happens if it’s a 15X, 20X or even larger event.

How do all these scenarios impact the way you view your personal finances? Modeling these scenarios out gives clarity into an otherwise blurry scene. As Rob’s argument indicates there are a host of reasons to take the reward and rebalance your financial life a little further away from the company. But the financial incentive to keep all the chips on the table should not be ignored.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 154: Heather McCullough, Co-Founder of Society 54

In this episode of the Charlotte Angel Connection, we talk with Heather McCullough of Society 54. During today’s podcast you’ll learn how Heather took a job and turned it into a business by paying attention to what she liked about her work.

Heather’s marketing expertise and her drive to help lawyers keep their attention on billable hours built the successful platform now employing 11 remote workers spread across the U.S.

Highlights from the episode include:

- Carving out company with passion

- Finding leaks in the buckets and using your knowledge to offer value

- Transitioning from employee to business owner

- Why gamifying fires up the competitive juices

- Adding technology to aid a coaching business

- Coaching vs technology for scaling a business

- Knowing when to expand

- Life in the day of an all-female team

- Challenges and benefits of remote working

- Funding challenges and benefits of being a female founder

- How entrepreneurship affects the family

- How travelling across the US in a camper van is like being and entrepreneur

- Heather’s impressive Georgia Bulldog bark

Check out this episode to learn how Heather took a profession and turned it into a profitable business, creating an asset that her family is proud of, and her legal customers are grateful for.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Founders Money: Secondary Sale or Recap

Introduction

Raising capital as a startup matures can help unlock liquid wealth for founders whether it be through a dividend recapitalization or a secondary sale.

Founders are left with the decision about what to do with the capital. We’ve generally thought it is a three-part conversation: celebrate (even a small celebration of reaching milestones can be impactful), pay down debt (whether it be car loans, mortgages, or other debt to free up cash flow), and/or invest it.

Today, let’s focus on the most talked about aspect of it, investing some or all of the capital.

Personal Financial Planning

It is important for founders to develop a financial plan and have an investment policy.

The plan would tackle cash flow through the next capital raise, financial independence modeling, a savings strategy for goals like kids’ college and other cash flow intense items, insurance, and most definitely income tax and estate planning. These all tie into developing a thorough investment policy built to get the founder and his/her family to the next stage of the business.

Let’s not get carried away though as the capital received from the dividend recap or the founder selling some shares still isn’t the greatest source of your wealth. Your shares in the company still likely hold the title of largest wealth component.

Investment Policy

Let’s look at an example. Assume you receive $1 million by selling some founder shares and leave $10 million in the business. The private equity group(s) would like to see the company 8 - 10x over the next 5 – 7 years so it will get you to a total equity stake in the company of $80 - $100 million (assuming no further dilution).

Equity Investment Portfolio

So, what impact does the investment policy have? If we stick with a liquid portfolio (no private assets), the historical rate of return of the S&P 500 is roughly 10% per year. Assuming it takes 7 years to get the desired company exit, the $1 million would roughly double – providing you with a portfolio worth approximately $2 million.

That’s a nice portfolio for many people and nothing to be upset about. However, it pales in comparison to the wealth you hope to create within the business over the same period.

Balanced Investment Portfolio

For reference, a balanced portfolio consisting of 60% equity and 40% fixed income would historically generate approximately an 8% annual rate of return – creating close to $1.7 million at the end of 7 years.

During the Great Recession in 2007-2009 a 100% equity portfolio likely would have been down approximately 50% or more from peak to trough while a portfolio including fixed income could have muted the returns to likely being down as little as 20-25% over the same period. In essence, do we want to play more defense than offense with the capital you’ve just taken off the table.

Portfolio Construction Considerations

Is the salary sustainable under most business conditions? If not, do we want to have a more conservative investment policy so less money is ‘at risk’. Are kids going to college in the interim? Is a spouse going to stay home so you need the portfolio to generate some income. All these concepts and strategies get flushed out in the financial planning process, which ultimately delivers an appropriate investment policy.

A solid financial plan doesn’t have to be overly cumbersome and time-consuming, but should include:

· Liquidity – for founders who likely haven’t had too much cash, having something liquid to tap into for any reason is a good thing.

· Safety – the company’s growth prospects are great but there is no guarantee it reaches its goals – or even survives the next 5-7 years. As such, taking the money and being conservative can alleviate some stress.

· Diversification – similar to the safety component above but worth mentioning that creating diversification is helpful. Concentrated positions are a great way to create AND destroy wealth. Being able to add a diversified portfolio to your net worth will lower the return but will begin to lessen the risk of concentrated wealth.

· Other financial goals – this could be allowing a spouse who may have been working to allow the founder to take a lower salary to step away. It could mean buying a new house, second home, new car or any other item.

· Subsidize income – in some rare instances, we still look to the portfolio to provide distributions to the founder to help the family live while the business continues to grow.

· Pay down debt – paying down debt frees up cash to be spent (or saved) and provides the family with greater disposable income.

Taxes

Additional things you want to do are annual tax projections (personal) as you want a better read on income taxes as taxes are an additional expense. How tight is the cash flow currently and what’s the impact of the investment policy on annual income taxes?

Estate Planning

And then ultimately you need to revisit the right estate planning strategy for you and your family. There is so much to think about from this perspective. Your own financial assets versus assets you have set aside for kids (this could be still under your control via a 529 or it could be through one of many trusts structures).

Do you want to maximize the wealth you leave to children/grandchildren? If so, planning now before the net worth potentially explodes can allow you to freeze your taxable estate – pushing growth to trusts and other structures you can still benefit from but are outside of your estate. Or are you more inclined to leave them something but want them to create their own wealth.

Even those differing views can lead you to different investment policies now – and especially into the future.

Summary

As you can see, an investment policy tailored to the family's needs is a fundamental pillar of any successful financial plan. It serves as a roadmap, guiding the family's financial decisions and helping them achieve their long-term objectives.

In essence, the portfolio should be set up to be a complement to what you have built through the company. It likely should be simple, liquid, and used as a tool to educate about portfolio construction post exit.

Keeping it simple then allows the actual work to begin. You build the company. The financial plan works around you and the family.

It’s updated and modified at least annually to reflect the natural changes that ebb and flow during life.

This includes an active income tax, estate document and insurance strategy that can be layered on over-time as the business grows.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 153: Marcia Dawood, Angel Investor

In this episode of the "Charlotte Angel Connection", Marcia Dawood, a seasoned angel investor, accomplished TEDX Charlotte speaker, member of the Angel Capital Association and SEC Small Business Capital Formation Committee shares her recipe of "doing good by doing well" by “helping entrepreneurs’ dreams come true’.

Marcia takes us through her journey of becoming an angel investor, how ALS (Lou Gehrig’s disease) helped her see the true value of investing in start-ups to affect meaningful change, and the value that ALL angel’s bring to the table when investing.

Key Highlights:

- Comparing the angel investment environment across the U.S.

- Becoming and angel by “contributing through curiosity” and embracing “story time”.

- The value of waiting for the right opportunity.

- How to start with as little as $50.

- How a family ALS diagnosis inspired Marsha to use angel investing to give back.

- The value of company contribution to changes vs. charities.

- Encouraging the younger generation to get involved.

Learn more about Marcia Dawood and the work she’s doing to promote angel investing in the U.S. and abroad, by checking out her podcast, the Angel Next Door. We definitely recommend Marcia’s Charlotte, NC TedX talk to learn more about her as well as the launch of her upcoming book.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 152: Leo Adams, Co-Founder and CEO of Skye Link

In the latest episode of the Charlotte Angel Connection podcast, we had the privilege of speaking with Leo Adams, the visionary founder of Skye Link Aerial Imaging. At Skye Link, Leo and his team have harnessed the potential of drones to offer solutions in industries ranging from real estate and construction to renewable energy. They are at the forefront of utilizing drone technology to provide valuable insights, streamline operations, and enhance decision-making processes.

We delve into the importance of systematizing processes for scalability. Leo emphasizes the significance of creating sustainable, repeatable systems within the business to reach new levels of growth.

Key Highlights:

- Leo Adams' journey from drone hobbyist to the visionary founder of Skye Link Aerial Imaging.

- Utilizing drone technology to provide solutions across industries, from real estate to renewable energy.

- Harnessing the power of data for efficient operations and decision-making.

- The significance of systematizing processes for scalability and growth.

- Personal insights into Leo's morning routine, growth mindset, and approach to personal and professional development.

- Aligning business growth with conscious capitalism and value creation.

- An inspirational story of innovation, collaboration, and success in the dynamic world of drone technology.

Tune in to this high-flying 152nd episode of the Charlotte Angel Connection podcast to gain a deeper understanding of how Leo Adams and Skye Link Aerial Imaging are redefining industries through the transformative power of drone technology.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 151: Steve Wilcenski, Co-Founder and CEO

Today, we have the pleasure of interviewing Steve Wilcenski, the co-founder of BN Nano, a company that specializes in developing nanomaterials with myriad properties and applications. With a focus on creating materials that are stronger, lighter, and more efficient in dissipating heat, BN Nano has captured the attention of various industries, including aerospace, defense, electronics, and clean energy.

During our conversation, Steve delves into the fascinating world of nanomaterials, sharing the challenges he faced during the company's early stages and the strategic approach to expanding their customer base. He sheds light on BN Nano's groundbreaking work in water purification, revealing how their nanomaterials can remove harmful substances from water sources thus addressing environmental concerns we now face.

Key Highlights:

- Introduction to BN Nano and its pioneering work in nanomaterials.

- Industries benefiting from BN Nano's materials: aerospace, defense, electronics, and clean energy.

- BN Nano's commitment to solving water pollution through innovative purification methods, through Invicta Water.

- Strategic partnerships and crowdfunding initiatives driving their growth.

- Plans to spin out the water purification division as a separate company.

- The urgency of BN Nano's mission to make a positive impact on global challenges.

Tune in to the Charlotte Angel Connection’s 151st interview with Steve Wilcenski to gain deeper insights into BN Nano's revolutionary nanomaterials.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 150: David Jones, Founder of Peak 10

Today we welcome David Jones to the podcast. David founded Peak 10 (now known as Flexential), a hybrid IT infrastructure provider focused on colocation, connectivity, cloud, and managed solutions.

David started Peak 10 in 1999 after being fired from a previous job. In 2010, he sold Peak 10 to a private equity group. In 2014, they sold again to another private equity group (who is still the majority owner of the company). David stayed on as Chairman until Peak 10 completed its acquisition of ViaWest in 2018, giving the newly formed combined company - Flexential - a national reach. Today Flexential is a multi-billion-dollar company.

We cover many topics during our conversation with David, including…

- Surviving a recent critical health event & how it altered his sense of purpose

- The importance of recognizing and playing to teammates’ strengths

- Raising $1.5 million in 4 weeks for the original Peak 10 business plan

- Why expecting success can be a mistake

- The power of resilience in health, business, and life

… as well as some of David’s accumulated wisdom from speaking with countless executives, founders, and investors.

Please enjoy this conversation with David Jones.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 149: Alan Fitzpatrick, CEO and Co-Founder of Open Broadband

Today we welcome Alan Fitzpatrick to the podcast. Alan is the cofounder and CEO of Open Broadband, an internet service provider (ISP) focused on serving traditionally underserved areas.

Alan and his cofounder, Kent Wenrich, started Open Broadband in 2016. Today, Open Broadband is one of Charlotte’s fastest growing startups, having been named to Charlotte Business Journal’s Fast 50 list each year since 2018.

We cover several topics during our conversation with Alan, including…

- How $42B of federal government grants are changing the ISP space

- Rural and urban markets both containing underserved segments

- Meeting an angel investor through a startup pitch event in Raleigh

- Weighing exit opportunities in growth and decision-making

- How this business differs from their previous 2 software companies

…as well as what’s next for Open Broadband in the coming years.

And for those brave souls who want to listen to our original podcast with Alan, here is Episode 35 and Episode 36.

Please enjoy this conversation with Alan Fitzpatrick.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

Charlotte Angel Connection Episode 148: Meggie Williams, Founder and CEO of Skiptown

Today we welcome Meggie Williams to the podcast. Meggie is the founder and CEO of Skiptown, an all-in-one ecosystem for bar, park, and pet care services.

Skiptown started as a dog-walking company named Waggle in 2016. Fast forward to late last year when Skiptown closed a $28M fundraising round to expand the concept around the country. By next year, Skiptown will have launched in Atlanta, Houston, and Denver in addition to the Charlotte location (with more coming).

During our wide-ranging conversation with Meggie, we cover topics including…

- Losing 95% of revenue during the beginning of COVID

- Why ‘Riding the Scooter in the Rain’ is an important company value

- Her process for finding great investors and board members

- Being a mom and CEO of a fast-growing startup

- How Charlotte’s entrepreneurial ecosystem has grown over the years

…as well as what’s next for Skiptown in the coming years.

Please enjoy this conversation with Meggie Williams.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.

QSBS and the Benefits of IRC Section 1045 and 1244

Last time, we wrote about the more popular provisions of Section 1202 and the Qualified Small Business Stock (QSBS) opportunity - excluding up to $10 million from capital gains taxes. It is an enticing enough provision for founders and investors alike. But there are additional provisions that are worth understanding as well.

If you need a quick refresher on the tax treatment/opportunity for founders and investors you can read our last article on Section 1202 here.

The other two less well-known benefits of QSBS are Section 1045 and Section 1244. To be clear, they are less well-known because they are nowhere near as beneficial as Section 1202 benefits but that doesn’t mean they should be ignored. Let’s dive into both and get a better understanding.

Section 1045 – Rollover of Capital Gains from QSBS

Many of you are probably familiar with 1031 or 1035 exchanges. These allow you to defer paying taxes when you sell real estate for ‘like kind’ real estate (1031) or allows you to move money from one insurance/annuity contract to another without paying taxes (1035).

Section 1045 is similar, but it applies to Qualified Small Business Stock (QSBS).

The same guidelines apply for Section 1045 as in Section 1202.

1) The issuing company must be a C Corporation.

2) The stock in the C Corporation must have been issued after August 10, 1993 and the gross value of the assets of the issuing corporation must have been less than $50 million at the time the stock was issued and immediately after.

3) At least 80% of the assets of the corporation have been used in the active conduct of one or more qualified trades or businesses.

4) The stock must have been acquired at ‘original issue’.

Section 1045 - What’s the benefit?

If a company meets the conditions set forth above and you have owned the stock for at least 6 months when you sell your shares in the company you can ‘rollover’ the gain to another qualified small business stock within 60 days.

Pretty simple. Own QSBS for at least 6 months. Sell QSBS and buy new QSBS within 60 days and you don’t have to pay income taxes on ANY of the gain. Of course, the gain and subsequent deferral election must be recorded properly on your tax return.

The initial law as passed referred specifically to taxpayers. However, it was amended one year later to a ‘taxpayer other than a corporation’ – meaning it applies to partnerships, trusts, LLCs, and more. The pass-through nature of Section 1045, therefore, seems to apply directly to angel funds and their members.

Section 1244 – Ordinary Income Loss on QSBS

Not all startups end with a successful exit. As a matter of fact, we know the vast majority of startups exit with a thud rather than a bang. While no one really likes to see an investment lose money there is a provision in the tax code to take a little sting out for investors of unsuccessful enterprises.

IRC Section 1244 is a provision in the tax code allowing stockholders of Qualified Small Businesses to treat part of your loss as an ordinary loss rather than a capital loss! How much? For married filing joint filers, you can claim up to $100,000 and for single filers you can claim up to $50,000!

Capital Gains versus Ordinary Income

Let’s put this in context. Under most instances when you have a loss as a stockholder you are able to claim it as a capital loss. If you own it for less than a year, it is a short-term loss and if you own it for more than a year it is a long-term capital loss.

For simplicity and brevity, I’m assuming everyone understands the rates and the way short-term and long-term positions affect each other.

Regardless, if your capital losses exceed your capital gains, you can use up to $3,000 as a capital loss to offset ordinary income and then carry forward the remainder, if there is any, to the following year. The loss carryforward can then be used to offset capital gains in that year.

So losses, as we’ve known them for some time, allow for up to $3,000 to offset ordinary income.

But IRC Section 1244 allows married filing joint filers to claim up to $100,000 to be used to offset ordinary income (individual and head of household can claim up to $50,000).

Requirements for Section 1244 Treatment

There are obviously necessary requirements for this special treatment.

1) At the time of issuance, the company was a small business corporation. The definition of a small business corporation means its aggregate capital can’t exceed $1,000,000 upon issuance of the stock. In the taxable year when aggregate capital exceeds $1,000,000 the company must designate which shares qualify;

2) Cash or other property was used to acquire the shares in the company; and

3) For the most recent 5 years prior to the loss, the company must have generated at least 50% of its income from sources other than passive investment income (income excluding royalties, rents, dividends, interests, annuities, and sales or exchanges of stocks or securities).

Similarly, to Section 1202 and the capital gains exclusion, you must own actual stock – not a convertible note for this to qualify. Fortunately, preferred stock qualifies for Section 1244 treatment as long as it was issued after January 18, 1984.

Planning Opportunities with 1045

Remember, Section 1202 allows you to realize the gains and not pay capital gains taxes on gains up to $10 million.

And Section 1045 simply allows you to DEFER paying capital gains. In essence, your basis in the first company carries over with you and serves as the cost basis in the shares of the second company.

For example, let’s assume you invest $100,000 into a QSBS in 2012, in 2016 it sold and your share was $1,000,000. If you were able to identify a new QSBS and invest in that company within 60 days of the sale of the previous shares, your basis in Company 2 would still be $100,000, not $1,000,000.

At some point in the future, when you sell the shares in the new company you will have to pay taxes with a basis of $100,000 (though you may still be able to claim an exclusion under Section 1202 as long as the shares are held for at least 5 years).

So why defer when you can claim the gain and not pay?

There doesn’t seem to be any discouragement from combining Section 1202 with Section 1045 – or vice versa.

Huh?

What if you sold your stock in a company and the gain was $15 million? You could exclude up to 100% of the gain (depending on the year the company was founded) of up to $10 million. However, the remainder of the gain ($5 million) would still be taxed. If you properly planned and had another investment opportunity lined up you could invest up to $5 million and still not pay capital gains.

You may also have invested in a company in 2007 when the exclusion was ‘only’ 50% of the gain up to $10 million. As such, you may not want to pay taxes on the other 50%, or some portion of it.

If that’s the case, you could ‘rollover’ the gain from one QSBS to another QSBS and defer the gain. By all measures, it would also allow you to qualify the gain within THIS QSBS.

Considerations for 1045:

1) Let’s assume Peter bought shares of Company X (a QSBS) in 2013 for $100,000. On April 1, 2016 the company sold and Peter’s shares were worth $1,000,000. This is a situation where the gain does NOT qualify for Section 1202 because the stock was not held for 5 years. As such, Peter has a gain of $900,000 – by all indications, the gain will be taxed at 23.9%. If he is able to identify a new QSBS to invest in prior to May 30, 2016, then he can defer all or part of the gain (depending on how much he invests in the new QSBS).

2) Let’s assume Mary bought shares of XYZ Corporation (a QSBS) in 2007 for $50,000. On June 1, 2016 the company is sold and her shares are now worth $750,000. Only 50% of her gain of $700,000 is excludable. If she finds a new QSBS stock to invest in, then she can reduce her capital gain for this year.

However, her cost basis in XYZ Corporation would carry her forward to the new company. If she holds the stock for 5 years though, all indications are that she can exclude 100% of the gain up to $10 million since she acquired the new QSBS in 2016.

Clearly, either one of these Sections of the Internal Revenue Code helps minimize taxes in any given year. However, the combination of the two can be pretty powerful. Unfortunately, taking proceeds from one successful QSBS and moving it directly into another successful QSBS is a lot easier to write about than to execute. If it was that easy to find winners all the time, we’d all be a lot happier – even come tax time these days.

Planning around Section 1244

Section 1244 limits who can claim the ordinary income loss to individuals, couples, and, in some instances, partnerships.

For an individual member of a partnership to make this claim, you need to have been a member of the partnership when the stock was acquired and stayed a member for the entire time the stock was owned.

As an added benefit, 1244 losses are treated as a trade or business loss for computing an individuals’ net operating loss (NOL). As a result, losses attributable to Section 1244 are allowed for NOL purposes without being limited to nonbusiness income. What does this mean?

Let’s assume I invest $100,000 into a C Corp making widgets in 2010. Five years later, in 2015, the business collapses and I lose all my money in it. At the same time, I quit my job in late 2014 and only had $25,000 of income for all of 2015. Since my stock is treated as a NOL, I can use $25,000 of the loss in 2015 AND carry-forward the remaining $75,000 of loss to the following year (technically you can carry it back for two years or carry it forward for up to 20 years). Pretty cool.

However, if I had invested $200,000 into the Widgets C Corp in 2010 while watching the business fail in 2015 and I had $500,000 of other income, I would only be able to use $100,000 of the loss to offset other income. The remaining $100,000 ($200,000 - $100,000) would be treated as a long-term capital loss and used to offset capital gains in the future. Any carry-forward for next year would simply be treated as capital loss.

With that being said, if I tried to sell my stock in the company for $50,000 in 2015, I’d be better off from a tax perspective to try to sell it over two years to maximize my tax benefit. Notwithstanding, selling failing, illiquid small business stock over two years may not be possible and the stock could be worth much less by waiting until the new tax year.

Summary

The tax code provides lots of opportunities for those who understand them. Next time, we will talk about Section 83(b) of the tax code and how that directly impacts the holding periods of Sections 1202, 1045, and 1244. These provisions can be utilized together when the

Many area professionals are not aware of the provisions of the tax code as they relate to startups. Seek out advisors who can engage in deeper dialogue on the interplay between the various provisions of tax code relevant to founders and investors.