Photo by Lefty Kasdaglis on Unsplash

Photo by Lefty Kasdaglis on Unsplash

A few weeks ago we posted an article about how to handle capital when offering shares through a secondary sale – or when taking cash in a dividend recap situation.

It didn’t take long before I received a note from Rob Cummings. To end the email Rob said, “while it was nice to reward myself with some liquidity for all of our hard work…, I do think about what could have been had I rolled.” Naturally that sentence grabbed my attention and I asked Rob if he’d be willing to co-author the follow up with me – the case for and the case against a secondary sale.

Fortunately, Rob agreed!

Before we dive into the pros and cons, it’s worth mentioning that not every Venture Capital or Private Equity investor wants to see their company founders taking money off the table. Clearly they want the founding team – which is one of, if not, the primary reason they made the investment in the first place – to be invested in the success of the company. And if they do allow you to sell some founder shares, they will clearly limit the amount they offer.

With that foundation laid, let’s dive right into arguments for taking secondary or rolling your equity. Here is Rob’s personal argument for why he did it.

Rob Cummings: Why founders should look to participate in the secondary!

My business partner and I started working in the equivalent of a closet at Packard Place (listen to their podcast post exit here). We had put in a grueling five years of 80-hour weeks paying ourselves below market. Early on we had written checks from our bank accounts and raised a small friends and family round to capitalize our startup.

Finally, the same institutional investors that had turned us down because our total addressable market was too small were starting to call us with interest in investing. We had built a profitable business over those five years and had measurable annual recurring revenue. However, we were still taking a very calculated approach to spending money and hiring employees to grow our startup.

Soon thereafter, a Venture Capital firm sent along a term sheet for $5.3M and were willing to allow some early friends and family investors and the co-founders to cash out some shares – or more simply put – take some chips off the table. We were faced with a tough decision. Do we “roll” all our equity or take a bonus for the hard work we had logged since company inception?

I decided to take $350,000 of cash from that fundraise. I knew that this $350k could be worth a lot more down the road if we were successful. But there were risks involved and we could no longer just “bet on ourselves.” We wouldn’t control our Board of Directors and it was inevitable that some of our decisions would be met with resistance. We had new partners that we also had to bet on to continue to grow our business. We had incredible momentum and I personally believed whole-heartedly in our business model and high performing team.

But it was time for me to personally take some chips off the table. With hindsight now 20/20, if I rolled those chips it would have returned 10x in less than 3 years when I eventually exited the business.

So why take the chips off the table? I had my personal story, but I also spoke to two other Charlotte Founders that did the same. I found four recurring themes as to why to do it:

1) family financial obligations,

2) risk aversion,

3) diversification, and

4) financial security.

Let’s break these reasons down further.

Family Obligations: When speaking with two other founders, both had situations where they needed to provide for their families. One had a child that had been diagnosed with a serious health issue and while that child had made tremendous progress, there were still a lot of unknowns. The other founder had retiring parents that required financial assistance.

Risk Aversion: Admittedly, this is one of the reasons I opted for some liquidity. I knew I was no longer in complete control of our business and had to bet on my new VC partners. I was a little bit older so I had lived through the tech bubble and the 2008 financial crisis. While I didn’t know it at the time, COVID was right around the corner. Outside factors beyond your control can always impact any business.

Diversification: Most founders will tell you that their generational wealth is tied to the success of their business. If your startup hits, it could be financially life changing. But if it does not, it could have the opposite impact. I know of founders that have tapped their home equity line or put personal guarantees on a small business loan to support their businesses. They need to diversify that risk and getting some early liquidity is a way to do that.

Financial Security: While $350k was not going to allow me to retire, it was still a lot of money that if invested correctly, would continue to grow into my retirement. That additional security was important to my family and I. I was able to pay off my mortgage, put some cash into safe investments, all while knowing that I still had a lot of upside with the equity that I rolled.

While William will argue to bet on yourself and roll your equity, I am comfortable with the decision I made.

I admit that I never went back and “did the math” on what could have been until I wrote this article. But it was absolutely the correct decision to make at that time. We continued to build a great business following that Series A round and I am thankful that our VC partners gave us that opportunity.

William Bissett: Why founders should keep their shares!

Rob’s argument is a very good one and it makes sense to a lot of people. Yet, I think of Eminem in this situation.

Look, if you had one shot, or one opportunity

To seize everything you ever wanted, in one moment

Would you capture it, or just let it slip?

If you have caught lightning in a bottle and this is your shot, do you want to let it slip to someone else?

We know that startup investors want to see the potential for their investment to at least 10X from where they bought it. We also know there is founder dilution with every capital raise – which we will touch on shortly.

If the general assumption is the business is able to 10X from your secondary sale then it is very easy to think about how much you are leaving on the table. For every $100k of stock you sell now, you lose $1 million in future value. But if the company does 50X from current value then for every $100k you sell now, you give up $5 million in the future.

In Rob’s example, if they had waited longer to exit and the business done 5X more (50X instead of 10X), then he would have left an additional $17.5M+ of wealth to end up in someone else’s hands, assuming no further dilution.

With proper estate planning (using GRATs, funding an IDGT or spillover Trusts, etc.), these funds can change the lives of kids, grandkids, and even brothers/sisters, and moms/dads. As Charlotte’s startup ecosystem continues to evolve and grow, it means the infrastructure to support startups to go public is going to strengthen. And that path only heightens how much would be left on the table with a secondary.

And even if it’s not leaving wealth to your family, it allows you to direct which charities and causes could benefit from your wealth creation event rather than letting that wealth be directed by someone else.

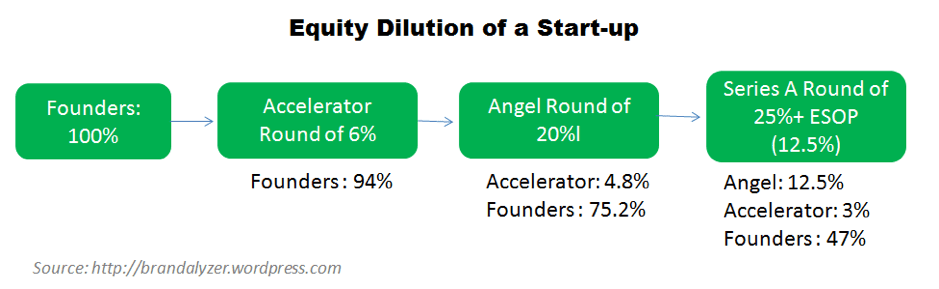

The other reason NOT to lighten up your shares in a secondary is because of future dilution. It is likely the company will raise more money down the road and when they do your shares will represent a smaller portion of the company. Selling shares now and being diluted further in future capital raises means you’ll participate even less in the company you built.

There are many ways to think about dilution over the lifecycle of a startup and there are all kinds of rules of thumb. Using the very simple illustration below, the founder here ends up with 47% of the company after the Series A and further dilution would occur at a Series B as well. And there are certainly situations whereby the founders are down to 10-20% of ownership by Series B. Under those assumptions, keeping everything you can becomes more important.

Conclusion

There is no right or wrong answer when these opportunities arise. We’ve seen situations arise where one founder participates in the secondary and the other does not. This doesn’t mean one founder is right and the other is wrong. It means one founder analyzed the company and their own personal needs and came to different conclusions.

We’ve long been fans of modeling financial events as they could progress and discussing the opportunities and negative impacts under each scenario. What happens if it’s only a 5x event or if you get laid off by the new board during a challenging time for the company. One the other hand, what happens if it’s a 15X, 20X or even larger event.

How do all these scenarios impact the way you view your personal finances? Modeling these scenarios out gives clarity into an otherwise blurry scene. As Rob’s argument indicates there are a host of reasons to take the reward and rebalance your financial life a little further away from the company. But the financial incentive to keep all the chips on the table should not be ignored.

William Bissett is the owner of and an Investment Advisor Representative of Portus Wealth Advisors, a Registered Investment Adviser. Registration does not imply a certain level of skill or training. Opinions expressed on this program do not necessarily reflect those of Portus Wealth Advisors. The topics discussed and opinions given are not intended to address the specific needs of any listener.

Portus Wealth Advisors does not offer legal or tax advice, listeners are encouraged to discuss their financial needs with the appropriate professional regarding your individual circumstance.

Investments described herein may be speculative and may involve a substantial risk of loss. Interests may be offered only to persons who qualify as accredited investors under applicable state and federal regulation or an eligible employee of the management company. There generally is no public market for the Interests. Prospective investors should particularly note that many factors affect performance, including changes in market conditions and interest rates, and other economic, political or financial developments. Past performance is not, and should not be construed as, indicative of future results.